My work as a Trader Performance Coach has brought me into touch with many successful poker players.

It seems poker players have the right set of skills to succeed in trading.

Poker players have learned to master ‘Uncertainty’ and embrace the power of ‘Not Knowing’!

There are many powerful lessons for traders from understanding how successful poker players handle risk and uncertainty.

Poker and Uncertainty

One of the the chief traits needed for success in trading is the ability to ‘Embrace Uncertainty’.

Poker forces people to learn that at a very early stage that:

• The best set-ups can go wrong.

• It is not the number of hands you win, but the size of the wins that count.

• Pot (money) management is vital.

• Feelings and instincts are neither to be ignored nor blindly trusted.

• Luck plays a role, but good process wins over the long term.

• Losing isn’t failure, its just an inevitable consequence of reality.

• Losing money should not be framed as a ‘loss’, but the cost of ‘taking a risk’.

Above all they know, that no matter how strong willed you are, the world doesn’t bend to your will.

Trading, Poker & The Power of ‘Not Knowing’!

My work requires me to have many deep and insightful conversations with traders and portfolio managers.

These remarkable conversations with highly successful individuals has given me a profound understanding of elite risk-taking.

I’ve come to appreciate is that learning to ‘Embrace Uncertainty’ is a key trait needed for success.

However, rarely is development of this skill given the prominence it deserves.

Far more emphasises is placed on learning about Federal Reserve policy or the Patterns of Divergence on a price chart.

These matter, but far less than developing the ability to embrace uncertainty and to become comfortable ‘Not Knowing’.

Developing a Mindset Which is Comfortable ‘Not Knowing’.

‘The only true wisdom, is knowing you know nothing’. Socrates.

‘Embracing Uncertainty’ requires becoming comfortable with ‘Not Knowing’.

No one knows where the market is going, no one knows where buyers will step in, and no one knows where buyers they will stop buying!

Some of the best traders I have worked with tell me they have no idea where the market is going anymore than the next person.

This acceptance of ‘Not Knowing’ and being comfortable with it, is a major factor behind their success.

‘Not knowing’ requires you to therefore remain curious, to keep exploring, to keep searching and to keep inquiring.

Paradoxically, it is when people become lured into being ‘too certain’, that their performance suffers.

In Markets, Our Need for Certainty is a Dangerous Ally.

As humans, we have a desperate need for certainty.

Certainty is a safe place, a place we can trust.

The need for certainty plays directly into our emotional aspects.

‘Being right’ satisfies our emotions and satiates our ego.

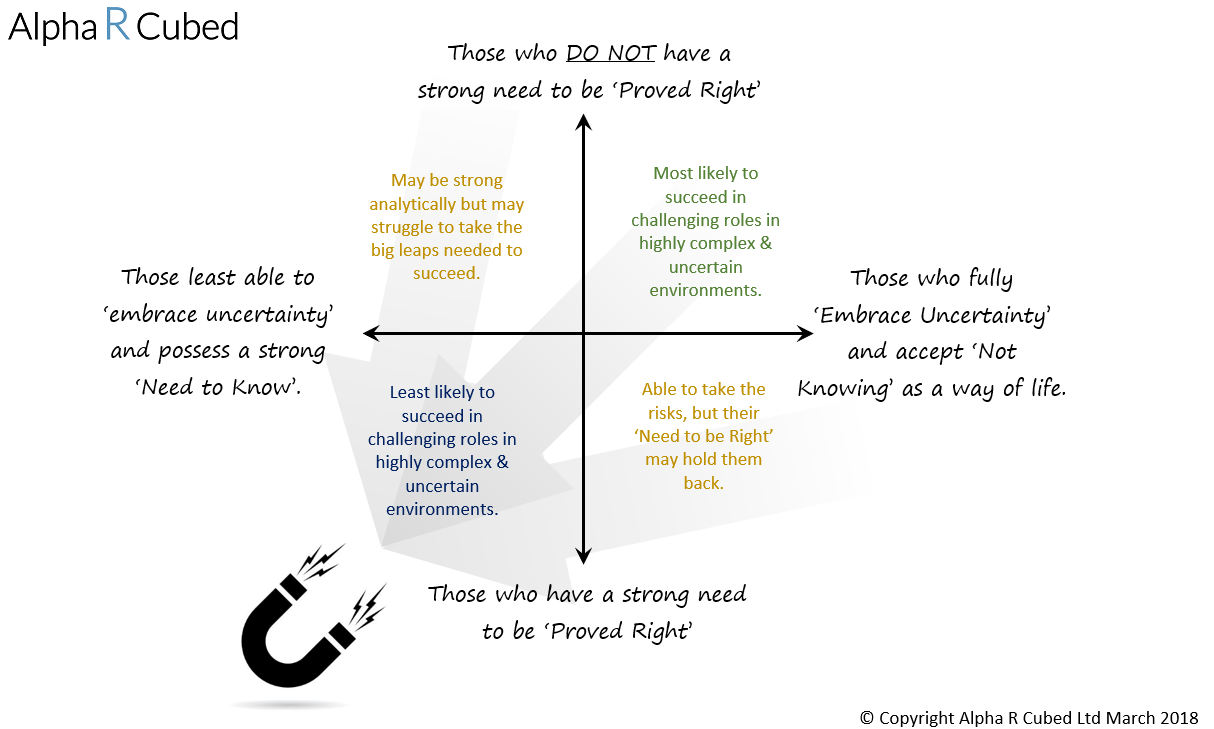

Not only do we have a ‘need to be right’, we also have a need to be ‘proved right’.

These needs create a strong gravitational pull on our behaviours and decision-making.

Those most likely to succeed in highly complex and uncertain environments, are those best able to not let these aspects take control.

Cultivating Curiosity: ‘Creative Indifference’.

In the philosophy that underlies my work as a coach ‘Creative Indifference’ is a term we use which is similar to ‘Not Knowing’.

‘Creative Indifference’ is incredibly powerful and liberating. It both stimulates and cultivates curiosity.

A curious mind keeps on searching, seeking, uncovering insights.

Time spent is not energy wasted, but rather seen as helping eliminate options and finding clues.

‘Creative Indifference’ paradoxically enables us to know more, to have deeper insights, to possess clearer perspectives, and to cultivate wisdom.

Great trading performance does not come from a place of certainty, it comes from being willing to ‘Embrace Uncertainty’ and ‘Not Knowing’, and to become comfortable with that.

If you enjoyed this article:

You may enjoy some of our other articles which explores a range of themes related to human performance in Financial Markets. This includes ‘Helping Traders Discover Their Inner Diamond‘, and other posts on our Articles Page.

We are passionate about working with those who want to better themselves.

If you are curious about any aspect of our work, or would like to understand more about how coaching could help you or your business: Then please email me at steven goldstein.