The following list of ‘Golden Trading Guidelines’ is reproduced from one of my trading journals from 2007.

I first started writing my ‘Golden Trading Guidelines’ in 2003, this was 16 years into my trading career. This also coincided with the start of a period which was to be my most successful by far.

These statements were personal to me. They were not rules but reminders of behaviours, mindsets and attitudes which were beneficial to me in my trading, and which if I strayed too far from, were coincidental with periods of under-performance.

The statements evolved and changed over a number of years, and with hindsight, may look slightly different if I were to write them today.

I would highly recommend traders and investors to produce their own trading statements personal to them. – The purpose of a list of personal trading or investing guidelines, is to act as a reminder of the aspects which both support and undermine a person in their work. By keeping these in a place visible to them, and checking their behaviours regularly against these, they may find they are better able to maintain the discipline needed. This should in turn improve a persons chances of achieving better ‘bottom-line’ risk performance.

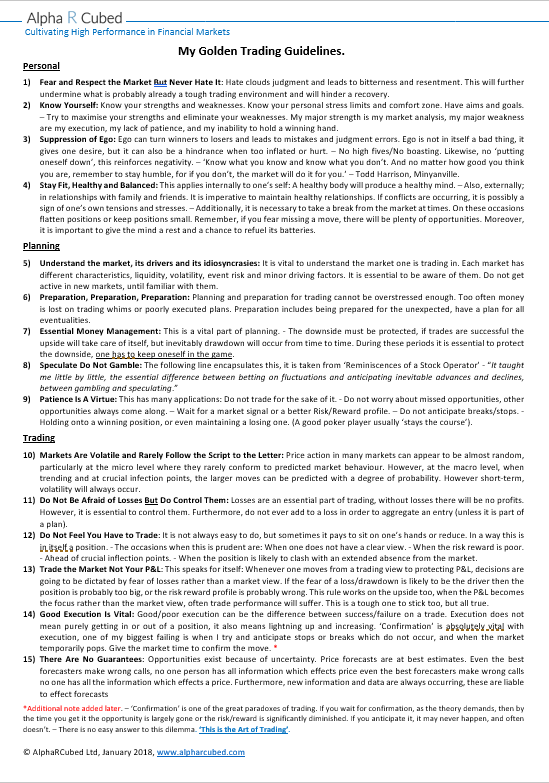

Please feel free to use these guidelines, either in this form, or as the basis for your own version. A printable version of these ‘Golden Trading Guidelines’is reproduced at the bottom of this article.

Golden Trading Guidelines.

Personal Guidelines

1) Fear and Respect the Market But Never Hate It: Hate clouds judgment and leads to bitterness and resentment. This will further undermine what is probably already a tough trading environment and will hinder a recovery.

2) Know Yourself: Know your strengths and weaknesses. Know your personal stress limits and comfort zone. Have aims and goals. – Try to maximise your strengths and eliminate your weaknesses. My major strength is my market analysis, my major weakness are my execution, my lack of patience, and my inability to hold a winning hand.

3) Suppression of Ego: Ego can turn winners to losers and leads to mistakes and judgment errors. Ego is not in itself a bad thing, it gives one desire, but it can also be a hindrance when too inflated or hurt. – No high fives/No boasting. Likewise, no ‘putting oneself down’, this reinforces negativity. – ‘Know what you know and know what you don’t. And no matter how good you think you are, remember to stay humble, for if you don’t, the market will do it for you.’ – Todd Harrison, Minyanville.

4) Stay Fit, Healthy and Balanced: This applies internally to one’s self: A healthy body will produce a healthy mind. – Also, externally; in relationships with family and friends. It is imperative to maintain healthy relationships. If conflicts are occurring, it is possibly a sign of one’s own tensions and stresses. – Additionally, it is necessary to take a break from the market at times. On these occasions flatten positions or keep positions small. Remember, if you fear missing a move, there will be plenty of opportunities. Moreover, it is important to give the mind a rest and a chance to refuel its batteries.

Planning Guidelines

5) Understand the market, its drivers and its idiosyncrasies: It is vital to understand the market one is trading in. Each market has different characteristics, liquidity, volatility, event risk and minor driving factors. It is essential to be aware of them. Do not get active in new markets, until familiar with them.

6) Preparation, Preparation, Preparation: Planning and preparation for trading cannot be overstressed enough. Too often money is lost on trading whims or poorly executed plans. Preparation includes being prepared for the unexpected, have a plan for all eventualities.

7) Essential Money Management: This is a vital part of planning. – The downside must be protected, if trades are successful the upside will take care of itself, but inevitably drawdown will occur from time to time. During these periods it is essential to protect the downside, one has to keep oneself in the game.

8) Speculate Do Not Gamble: The following line encapsulates this, it is taken from ‘Reminiscences of a Stock Operator’ – “It taught me little by little, the essential difference between betting on fluctuations and anticipating inevitable advances and declines, between gambling and speculating.”

9) Patience Is A Virtue: This has many applications: Do not trade for the sake of it. – Do not worry about missed opportunities, other opportunities always come along. – Wait for a market signal or a better Risk/Reward profile. – Do not anticipate breaks/stops. – Holding onto a winning position, or even maintaining a losing one. (A good poker player usually ‘stays the course’).

Trading Guidlines

10) Markets Are Volatile and Rarely Follow the Script to the Letter: Price action in many markets can appear to be almost random, particularly at the micro level where they rarely conform to predicted market behaviour. However, at the macro level, when trending and at crucial infection points, the larger moves can be predicted with a degree of probability. However short-term, volatility will always occur.

11) Do Not Be Afraid of Losses But Do Control Them: Losses are an essential part of trading, without losses there will be no profits. However, it is essential to control them. Furthermore, do not ever add to a loss in order to aggregate an entry (unless it is part of a plan).

12) Do Not Feel You Have to Trade: It is not always easy to do, but sometimes it pays to sit on one’s hands or reduce. In a way this is in itself a position. – The occasions when this is prudent are: When one does not have a clear view. – When the risk reward is poor. – Ahead of crucial inflection points. – When the position is likely to clash with an extended absence from the market.

13) Trade the Market Not Your P&L: This speaks for itself: Whenever one moves from a trading view to protecting P&L, decisions are going to be dictated by fear of losses rather than a market view. If the fear of a loss/drawdown is likely to be the driver then the position is probably too big, or the risk reward profile is probably wrong. This rule works on the upside too, when the P&L becomes the focus rather than the market view, often trade performance will suffer. This is a tough one to stick too, but all true.

14) Good Execution Is Vital: Good/poor execution can be the difference between success/failure on a trade. Execution does not mean purely getting in or out of a position, it also means lightning up and increasing. ‘Confirmation’ is absolutely vital with execution, one of my biggest failing is when I try and anticipate stops or breaks which do not occur, and when the market temporarily pops. Give the market time to confirm the move. *

*Additional note added later. – ‘Confirmation’ is one of the great paradoxes of trading. If you wait for confirmation, as the theory demands, then by the time you get it the opportunity is largely gone or the risk/reward is significantly diminished. If you anticipate it, it may never happen, and often doesn’t. – There is no easy answer to this dilemma. ‘This is the Art of Trading’.

15) There Are No Guarantees: Opportunities exist because of uncertainty. Price forecasts are at best estimates. Even the best forecasters make wrong calls, no one person has all information which effects price even the best forecasters make wrong calls no one has all the information which effects a price. Furthermore, new information and data are always occurring, these are liable to effect forecasts.

The original guidelines from my journal can be seen below, with a printable document version below.

If any readers would like to print a version of this document for themselves, a printable copy is attached below.

Thank you and good luck.

Steven Goldstein