Sssssshhhhh – Trading Emotions !!!!!! Not to be mentioned in the trading room.

Emotional strength rather than intellectual ability is the biggest factor behind success in trading, yet its probably the one topic no one wants to discuss it.

In this article, we seek to raise awareness of this key aspect of Financial market Performance.

Those Pesky Trading Emotions.

Emotions, we all have them: They impact our performance and affect the quality of our decision-making.

But nobody wants to talk about them. The are the ultimate ‘elephant in the trading room

Emotions are the Elephant in the Trading Room

Trading requires making important decisions under intense pressure in fast fluid and uncertain environments

A traders existence is highly stressful. Yet traders need to be confident and remain objective.

They need to be able to focus on their goals whilst keeping their mind free of negative, destructive, obsessive thoughts.

Emotional Stability: Tipping the Odds in your favour.

In order to succeed at trading, being good is not good enough, to succeed you need to make yourself great!

The odds of success in trading are incredibly slim.

Research has found that the success rate for trading is than 1%, which contrasts to the often-cited figure of around 20%. (Source*)

These are the cold hard facts.

This means that in order to succeed at trading, being good is not good enough, to succeed you need to make yourself great!

Developing your emotional skills is where the answer lies. Intellect is useful but it is unlikely to be the defining factor in long-term success.

Developing Emotional Stability.

Your emotional attributes are part of who you are, you can work with them or against them. .

The emotional side of trading has many facets, Emotional Stability,being is just one of them.

Other facets include Emotional Agility, Emotional Intelligence, Risk Intelligence, and Resilience.

Strength in these areas leads to many benefits including:

- Mentally healthier and stronger

- Less stressed and more resilient to setbacks.

- Better able to adhere to Money Management rules.

- More patient and disciplined.

- Less likely to fall victim to Cognitive Biases

- More effective and productive.

- Improved reactions to new information.

- Less susceptible to fear based decisions.

- More autonomous, less likely to be influenced negatively by others.

- Higher levels of confidence and self-belief.

Sport and developing Emotional Strength.

Sport has been well ahead of trading and investment in this respect.

For some years there has been an increased emphasis on mastering the emotional side of sports performance.

Roger Federer is not superior because he has the best forehand, the sweetest backhand, or the most powerful serve.

Federer holds his nerve, and remains calm and unruffled in tense moments.

Double faults or miss-timed shot do not affect his game as they would other players.

At the margin, success is about managing emotions.

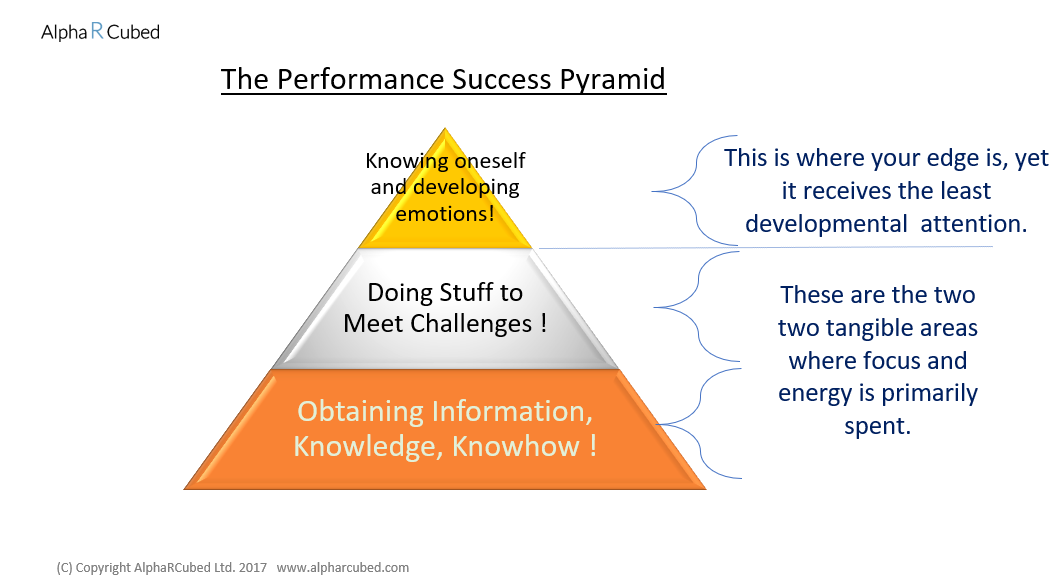

The image below highlights where we feel the developmental edge for great performance lies.

You Are What You Can Make Yourself Into.

In a tribute to his former coach following his recent death, Federer recalled how his coach had ‘moulded him as a man and a player’.

It was not just his technique he worked on, but the person.

This is what great coaching does, it helps people move close to fulfilling their full potential.

Working with a Performance Coach is one of the most effective ways to develop the emotional attributes needed for success.

Your emotional attributes are part of who you are, you can work with them or against them.

If you choose to work with them, then your odds of long-term success are greatly improved.

*Research Source: The Cross-Section of Speculator Skill: Evidence from Day Trading. Brad M. Barber, Yi-Tsung Lee, Yu-Jane Liu, Terrance Odean, 2014.

This report analysed 15 years of day trading performance of traders on the Taiwan Stock Exchange.In the average year about 450,000 Taiwanese individuals engaged in day trading.

The research found that on an average year about 20% of these day traders earn positive abnormal returns net of fees,

but that less than 1 percent of the total population of day traders from the prior year go on to earn reliably positive abnormal returns net of trading costs in the subsequent year.

—

If you enjoyed this article:

You may enjoy some of our other articles which explores a range of themes related to human performance in Financial Markets. This includes, ‘It’s Not the Market You Overcome, It’s Yourself‘ and other posts on our Articles Page.

We are passionate about working with those who want to better themselves.

If you are curious about any aspect of our work, or would like to understand more about how coaching could help you or your business: Then please email me – Steven Goldstein.