Imagine an aspiring sprinter who is physically tall, slim and wiry. The sprinter may train and practice hard, developing the skills and tactics required for sprinting success, however he was one major disadvantage, he is not built for sprinting. His physique would be more advantageous if he was a distance runner. Thus when competing at a higher level, he would start coming up against sprinters who have a defined ‘edge’, they are physically built for sprinting. In athletics, having the appropriate physique for a discipline provides a clear edge: Sprinters are powerfully built, distance runners are thin and wiry, whilst jumpers and throwers possess various physical attributes relevant for their disciplines. In financial markets, the equivalent to athletics physique, is ‘Risk Personality’, the characteristic patterns of thinking, feeling and behaviour which people display in how they perceive, tolerate, and show propensity for risk-taking. In the same way that people are built differently for different athletic disciplines, so people possess varying personalities, which favour different approaches to engaging with risk. In my work as a performance consultant and coach working with traders and investment professionals, I have found that certain personality types have a distinct ‘edge’ when taking and managing financial market risk in certain different contexts. Rather like there is a field of athletics which favours each and every body shape, there is a form of financial market risk taking which works for each and every personality type.

There is a growing body of research which is starting to focus on how understanding risk personality can have a profound impact on the performance of individuals in financial markets and on the collective performance of financial market businesses. A couple of months ago the Financial Times ran an article with the following headline:

This related to a fascinating piece of research carried out by a group of senior academics which highlighted the degree to which personality affected ‘Risk Taking’ performance of senior bankers. One of the starkest findings from this research paper, was that “Style”, a category which included personality, talent and work ethic, accounted for as much as 72% of the difference in banker’s risk behaviour. On the other hand, aspects which are traditionally considered relevant, such as remuneration, accounted for only 4%, and education and age accounted for just 5% of the differences. In this article, I will explore ‘risk personality’ and introduce some private research that myself and my colleagues have been doing around risk-taker personality. I will explain how and why understanding and being more aware of your risk personality can help you improve how you take and manage risk, and how this can be the start of a further development of your capabilities as a risk-taker which leads to improved and more consistent performance. Personality testing is more than just about helping assist employers in their hiring decision, they can be used in many ways to help improve performance, enhance working practices, and support teams and businesses to improve how they work and function.

Different Risk Personalities

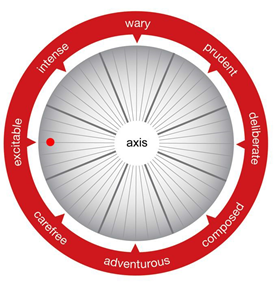

Since the beginning of last year myself and my colleagues have been analyzing the Risk Personalities (Risk Type) of a wide population of individuals engaged in financial risk taking roles. This includes Traders, Portfolio Managers and Investment Managers at a number of investment banks, energy trading firms, fund management firms, and hedge funds. We have analysed over 100 individuals using a powerful ‘Risk Profiling’ tool called the ‘Risk Type Compass’. This tool, developed by Psychological Consultancy Ltd, is the first tool of its types that focuses objectively on people’s risk-taking behaviours. This tool builds upon decades of research into human personality and risk behaviour, and categorizes people into different risk personality groups, known as ‘Risk Types’. The graphic below, shows the Risk Type Compass, with the 8 different risk types. Every individual falls into one of the Risk Types, or into a neutral ‘axial’ grouping in the middle. Close proximity to the centre indicates a mild form of that Risk Type, whilst close proximity to the edge indicates a strong form of that Risk Type.

Fig 1 – Risk Type Compass: The red circle indicates an individual’s position on the risk type compass.

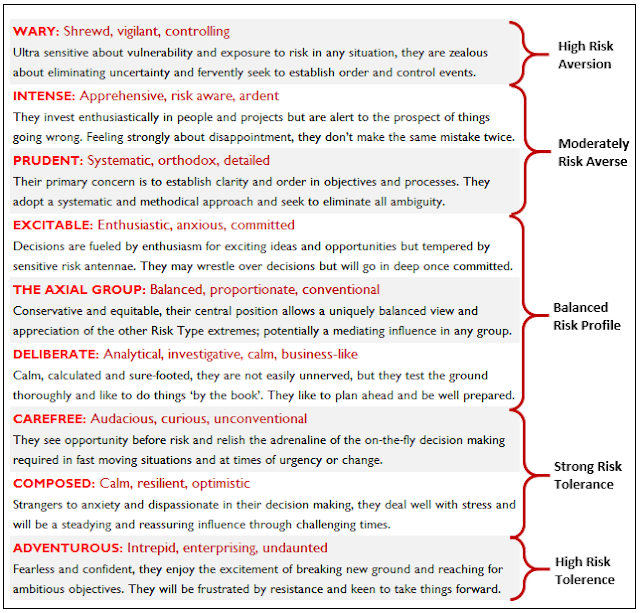

Each of the risk types reflects different characteristics, which influence how a person is likely to behave, think and act when faced with high risk situations. The table below shows an overview of the Risk Types.

Fig 2 – Definitions of the Different Risk Types.

Risk Behaviour, is seen as a construct of Risk Type and Risk Attitude. Risk Attitude, is variable, and shaped by outside forces such as other people’s influences, a person’s situation, motivations, experiences, fears and desires. Risk Type on the other hand is fixed and rarely if ever changes. Alignment or congruence between Risk Type and Risk Attitude are crucial factors in people achieving success as risk-takers and risk-managers. In the athlete example, there was incongruence between the desire to be a sprinter and the physique needed to be successful as a sprinter. This does not preclude success, but it does mean that achieving success will be significantly more difficult.

An example of a high degree of congruence between Risk Attitude, as displayed by their approach, and Risk Type, is demonstrated by one of the most successful traders we tested. This individual works at a large hedge fund, and is one of their most consistently successful portfolio managers. This individual’s risk type is a very strong form of ‘Wary’. Wary risk types are typically highly risk averse, cautious and often display heightened anxiety around taking and managing risk. However, they are also highly analytical, very detailed and focused, this makes excellent at picking up on minor dislocations and predictable patterns very quickly. This individuals approach involves looking for very short-terms opportunities in highly liquid FX markets. When these reveal themselves, he hits the market hard, and is often in and out very quickly. Being highly ‘Risk Averse’, he is very sensitive to downside risk, and works to eliminate poor risk reward trades and trades with a heightened risk of a sudden negatively illiquid situation. This approach is ideal for his risk type, he has found a style and approach highly congruent to his Risk Type. He ensures he operates exclusively in situations and markets where he can work his ‘edge’. Beyond this way of working he has little or no ‘edge’, or more correctly a ‘Negative Edge’. A ‘Negative Edge’, means he will be competing against others who have a positive ‘Edge’, courtesy of characteristics associated with their Risk Type. A big part of his success, is that he avoids getting involved in activity outside his own particular ‘theatre of operation’, where he has no ‘edge’.

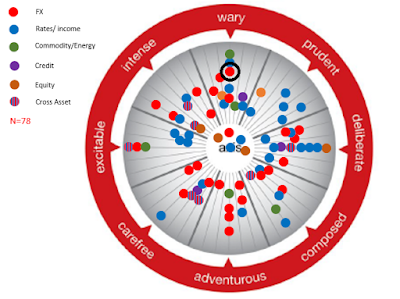

The next graphic highlights the full distribution of successful traders in our population tested thus far. We have eliminated traders who have less than 5 years’ experience from the larger group, to ensure we include only those who are able to sustain their success. This leaves 78 risk-takers whose experience ranges from 5 to nearly 50 years. – In this graphic, the portfolio-manager referenced above is circled.

Fig 3 – Distribution of all ‘Experienced’ traders tested over the past 18 months. [An individual’s position on the ‘Risk Type Compass’ is determined by an objective test based on decades of research in personality psychology]

Developing an ‘Edge’ for greater success

An ‘edge’ is that angle or aspect one has which contributes to them producing a sustainable positive return whilst being able to withstand drawdowns when they inevitably happen. Developing an ‘edge’ takes skill, hard-work, persistence, and many other numerous factors. However, none of them are of much value if the individual is not working in a way which is congruent to their risk personality (Risk Type). Aligning people’s approach with their risk type, and then helping them to develop and leverage it further often has a profound effect in helping them to develop far stronger performance. An example of this occurred with an FX options trader I coached at a major investment bank. This individual had been doing the job for about 10 years, so was highly competent, however he was rarely if ever achieving outstanding performance. His Risk Type was ‘composed’, this meant he was calm, self-assured and confident, however his trading approach was far more consistent with that which we witness from traders on the other side of the compass, the ‘Excitable, Intense, Wary’ types. When we explored this, it was apparent that in his formative years he had learned from and been mentored by traders of these types. Their influence had shaped his Risk Attitude. The Risk Type Compass assessment, together with the coaching programme, helped raise his awareness of this and worked with him to modify his approach to a style more congruent to his Risk Type. Over the next few months his performance started to improve, and eventually it took-off in a way he had previously never experienced. He described it as like having the shackles removed. It is noteworthy we have examples the other way round, where ‘Intense’ types were adopting approaches of the composed type, and likewise this also proved inappropriate. It is not the approach per se that was incorrect, but an approach that was inappropriate for the ‘Risk Type’. – This is a personal bugbear of mine. – Too many people are mentored, learn from, or are influenced, by ‘generic’ or ‘inappropriate’ trading approaches which handicaps and hinders their development and success.

The Risk Type Compass and Risk Style

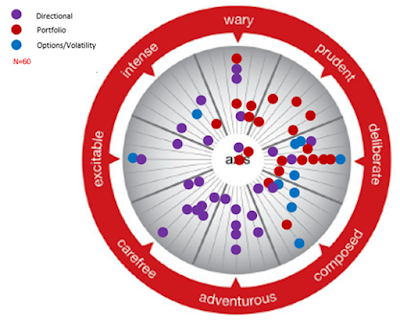

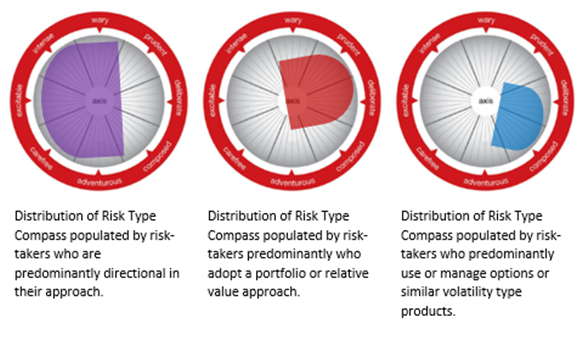

In trading and investment, there are certain types of risk-taking and risk management styles suited to certain Risk Types. The following graphic highlights an example of this. This graphic shows discretionary risk-takers only. In this graphic we have colour coded risk-takers into three discrete groups:

1) ‘Directional’ in their approach.

2) ‘Portfolio’ or ‘Relative Value’ in approach.

3) ‘Options’ or similar volatility type product Risk-takers.

Fig 4 – Distribution of all ‘Discretionary’ risk-takers tested, categorized by style.

There are clear distinctions between the areas of the graphic being populated by the different types of approach. These areas are highlighted on the smaller graphics below:

Fig 5 – Highlighted areas of area Risk Type Compass populated by the various ‘Risk-Taking’ approaches.

Directional Risk-Takers show a clear bias towards the centre and left of the compass. The left side of the compass tends to be populated by risk-takers who are influenced by emotional/intuitive aspects relative to the rational/logic aspects. Individuals who have a preference for ‘directional’ trading are able to use the emotions of the markets to ‘feel’ the market. They have an edge by using their intuition and trusting their sensing abilities to cut through the noise. They seem particularly adept at finding value by reacting to market dislocations and opportunities, and seem to sense where markets are over-stretched or likely to extend the current move.

Not highlighted in this data, but relevant to this discussion: Individuals placed towards the top of the compass display more ‘risk-averse’ behaviours, whilst individuals towards the lower side of the compass tend towards more ‘risk-tolerance’. We see this manifest itself in risk-takers towards the topside tending to be more tactical, using price action to identify value and typically holding risk for shorter periods. Risk-takers towards the lower side tend to adopt a more strategic ‘big-picture’ bias, placing more emphasis on ‘macro/fundamental’ drivers of value, and tending to ride market volatility whilst holding risk for longer periods.

‘Portfolio’ or ‘Relative Value’ risk-takers have a clear bias towards the right side of the Risk Type Compass. The right side tends to be populated by people who have a more logical/rational perspective. These risk-takers have a preference for using logic and rational/evidence-based approaches to finding value and managing risk. They prefer to adopt approaches which remove some of the emotional influences from their decision-making. They also have a preference for using a modelling approach to identify value as a way of cutting through the noise and finding value creating opportunities. Not shown in the data, but which has come through discussions with many of these individuals, is a bias towards systematic trading. Systematic trading further removes the emotion from decision-making.

Options and volatility based risk-takers are predominantly distributed towards the lower right-hand side of the compass, with a couple of notable exceptions. Managing an options portfolio, with its many additional ‘moving-parts’ and constant high exposure to risk, seems best suited to a hedged/portfolio approach where risk can be warehoused, and value extracted from active management of the warehoused portfolio. Given the complexity of these products and the high levels of volatility and uncertainty present, we tend to see this suit an approach where emotional influences are reduced. Thus positioning them to the right of the compass. Additionally, options/volatility trading and pricing requires a mindset suited to a modelling approach, which again mitigates against individuals on the left hand side who tend to be more intuitive and subjective in their approach. The high levels of risk and large volatility present in options portfolios, means that this is well suited to individuals more comfortable with ambiguity and uncertainty. Thus not surprisingly, we are seeing types engaged in options trading tend towards the lower side of the Risk Type Compass. tolerant.

There are a couple of notable exceptions which if anything proves the rule: The ‘Options Trader’ in the ‘Excitable’ Risk Type group for example, is a ‘short-dated’ options trader. ‘Short-dated’ options have a maturity of just a few days, and in some cases just a few hours. It is extremely difficult to model very short-term options, and the success of this individual is largely based on being able to ‘feel/sense’ the market, and react far quicker than the logical/slower traders. – The second example is an individual who is in the ‘Intense’ group. This individual, under ‘undue influence’, adopted an ‘options’ approach to taking and managing risk. Previously he had been a ‘tactical’ directional trader. His performance diminished significantly since adopting this approach, which was inappropriate for his Risk Type.

Developing your ‘edge’ by understanding ‘Risk Type’.

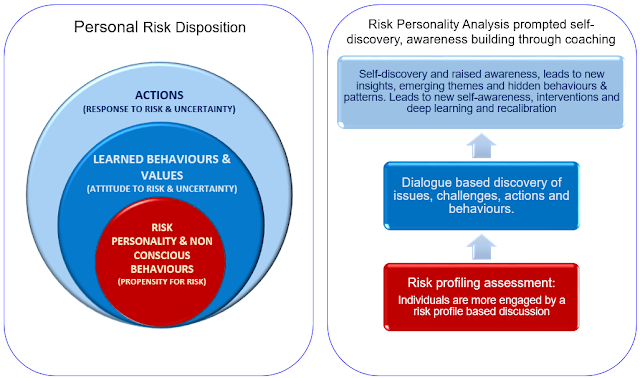

It is beyond the scope of this article to explore in detail how we build upon the understanding of risk personality to help individuals develop their ‘Edge’. However, I will briefly add that our work with risk personality and the subsequent discussions and explorations which result from this are highly illuminating and help the individual in most cases to generate far higher levels of performance. Risk Personality Profiling is central to our approach of understanding risk disposition, and leads to further qualitative explanation and discussion to help raise awareness of and improve risk behaviours (See figure 6 below). Experienced traders have seen sustained performance improvements which in many cases have seen increases in the range of 50% to 100% of prior years’ average annual performance, and in some cases far more. The ‘Risk Type Compass forms the basis for ‘Prompted Self- Discovery’, where the coach supports and facilitates the individual to discover more about themselves as a risk-taker, this includes:

- Understanding one’s personality and how it influences the way they think, behave and act.

- Becoming more self-aware, both in the moment and bigger picture.

- Improving how one manages within heightened levels of uncertainty and ambiguity.

- Becoming more conscious of human behavioural aspects and how they impact /distort perception and decision-making.

- Developing Metacognition, the ability to think about how one thinks.

- Developing self-belief and trusting one’s process and practice.

Fig 6 – Risk Personality Profiling as Central to our approach to understanding people’s, teams and businesses ‘Risk-Disposition’.

Wrap-up

There are many ways in which understanding ‘Risk Personality’ can help financial market businesses and individual risk takers. At the micro level it can help improve personal risk performance. At the business level it can lead to better team performance, improve recruitment and hiring, and ensure that new talent and hires are successfully matched to their role and on-boarded into the business. At the macro level it can help improve risk culture, help firms understand their own Risk DNA thus improving risk management, senior leader risk taking and decision-making, and improve leadership functioning and performance. There are many other ways in which deepening understanding of individual, team and organizational personality can lead to enhanced business performance, from enhancing sales, improving project implementation, facilitating smoother change processes, developing organisation awareness in a way which can have profound effects for business. In my own work, it has been the start of significant performance improvements for people, which in many cases has led to direct attributed PnL improvements worth many millions of dollars. In the ‘behavioural age’ this sort of work is likely to increasingly be recognized as a significant input to driving better, stronger and more effective performance.

If you would like some further insight into the Risk Type Compass and this topic, myself and Geoff Trickey of Psychological Consultancy Ltd produced a webinar on the subject at the this link.

—

Steven Goldstein is a leading Performance and Executive Coach working with Traders, Banks, Energy Firms and Hedge funds: He is Managing Director of Alpha R Cubed, which works with banks and investment firms to improve their human capital within their financial risk businesses. To know more about Alpha R Cubed, visit their website www.alpharcubed.com or email Steven at steven.goldstein@www.alpharcubed.com.