During a recent conversation with a coaching client, the client remarked to me that he could not see any logic or rationality in anything in the market. – He wanted my opinion on this, and how he should manage this. I explained how often the logic we apply to the market is rarely fully formed or complete. If we wait for completion of the logic, the market has usually moved to discount it. Thus, often we must make a decision based on incomplete information. This is challenging for many, but it is also often the best time to trade. At this stage, the market has yet fully moved to price in new ‘value factors’, thus the risk reward is much higher, equally though there is a risk that the picture we see forming may be false. This is why, in my opinion, great traders, are often ‘Masters of the Best Guess’.

The Human Mind and Best Guessing

Making a best guess is extremely challenging. The human mind dislikes incomplete pictures made from a few basic focal points and often seeks to complete the picture. As humans, we are quite capable of abstracting successfully from limited data points, but equally this can also lead us astray. We worry more about this second aspect, than the first, so our minds seek more complete answers, and if it doesn’t have time or data to construct them, it will create a narrative to complete the picture. The danger, is this behaviour can undermine us and our vision can become easily distorted by this. The narrative may be correct, but equally it may represent a logic based on a false premise used to justify a ‘feeling’ based decision, or a decision not necessarily based off clear logic (Which abstractions often are).

I confided in my client that when I was a trader, this happened to me on many occasions, and sometimes seriously sabotaged my trading. Though bizarrely the example I shared with him, was a case on one my most successful trades. The rationale for the trade was based on a technical set-up, however once the trade was in motion, I then started to construct a fundamental narrative which fitted in with my actions. – Technical Analysis is in my opinion an example of an abstraction type approach rather than a logic based narrative. – The narrative which I constructed was based on macro-economic fundamental case, this constructed narrative was completely wrong however, and left me with an incorrect fundamental assessment of the market which nearly contrived to undermine that trade (more of which I will explain later).

The discussion with my client continued and my client raised the famous trading mantra; – ‘Trade What You See, Not What You Think You See’. I am fascinated by this mantra as it both great advice, but also flawed. – On the one hand, it reminds us to check ourselves and not always overthink matters, as I had done above. On the other hand, this is actually what we do, we cannot help overthink things because we are made this way. Thus trading ‘What we see’ and ‘What we think we see’ are one and the same. To add to the challenge, particularly in markets, what we see is rarely, if ever, a true and complete image or view, but rather is pieced together complex image, and our understanding of it is based on templates from experience. This is how the brain works, it doesn’t see things in their true form, but constructs an image based off what we expect to see. Optical illusions provide good examples of this: As an example, look at the following image.

Ridiculous as it may seem, the squares marked A and B are identical in colour and shade. – However, your brain is not seeing this because it expects something different given the checkerboard pattern and the shadow cast by the green cylinder. Your brain is telling you that square A and B are different colours, and no matter how hard you stare at them, whilst they remain in this format, your brain will not allow you to see the truth. You may wish to go to the link http://persci.mit.edu/gallery/checkershadow which has proof and an explanation.

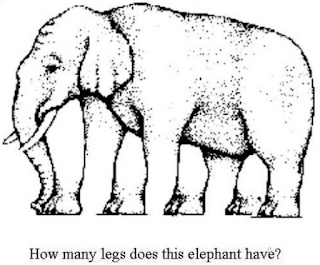

Another excellent example, which I think provides a better metaphor for markets is this image:

Markets never show us a clear and logically constructed picture. There are just too many variables, different views, vistas, and possibilities. We are therefore left making ‘best guesses’, whether we like it or not.

Thus, your job as a trader is to become the master of playing the ‘best guess’ game. It is for that reason we need to have checks on our behaviours, on our optimism and pessimism, on our own arrogance and on our levels of confidence, both over- and under. It is why we need some sort of process and structure to our trading, our on-going analysis, and the juxtaposition of the two. A strong process and structure keeps us safe, as well as us to engage in market risk. It is why we need a strong risk management practice, and a process or system for trade selection and positioning.

In the example, I shared with my client from my own trading, at the time I was short of German Government Bond Futures (Bunds) in a very sizable position in a sharply declining market. I had positioned myself based on a long-term technical set-up and structurally moved into the trade in a way which enabled me to have my full position on. I then sat with this trade for a couple of weeks, trailing the stop the whole way, and going with it as it moved to a pre-set target I had identified. However, what happened after the trade started its move was that I started to construct a strong fundamental case for the move and a rationale for being in the trade. This rationalisation very nearly sabotaged the trade. The fundamental rationale I had constructed was completely wrong and seriously flawed. The case I had made was a scenario where the market would move significantly further. Thus, after I exited the trade at my pre-set target level, I started to agonise over the fact that I may be leaving serious ‘money on the table’. I came very close to re-entering the trade several times, which as it turned out would have been calamitous. During this time, I had to fight with myself for several weeks not to do it. Eventually the market did start to retrace, and I was extremely relieved that I had not re-entered the trade, however so strong was my fundamental rationalisation, that I then was unable to get into the trade on the other side, and ended up missing a huge move the other way.

Summary

We cannot help ourselves as humans in applying logic and rationalisations to fill gaps in data or to try to explain data or events, it allows us to make sense of things. This is both our blessing and curse. For me, greater self-awareness is what is needed to allow us to capture the upside capabilities of our selves, and to limit the downside which results from these. Greater self-awareness, means understanding the basic drivers of your decision-making and behaviours, developing an understanding of who you are from a ‘third person’ perspective, and being conscious of how your emerging situation impacts your behaviours and actions. This is what will help you to increasingly become a master of the ‘best guess’.

Best of luck.

Steve Goldstein